30+ which fico score for mortgage

Though a 30-year mortgage is the most. Web As you can see in this example using todays national rates a person with a FICO score of 760 or better will pay 231 less per month for a 216000 30-year fixed-rate mortgage.

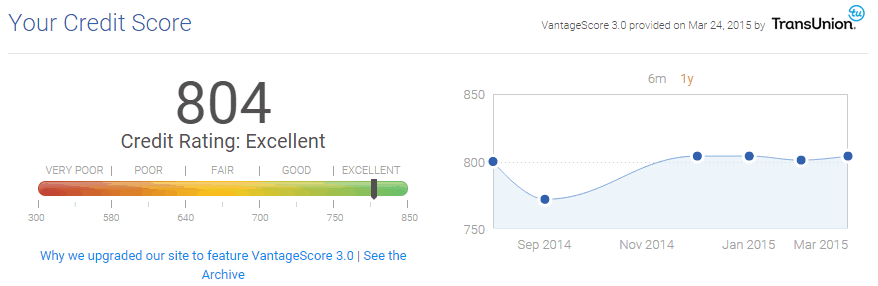

Your Credit Score Might Not Be As High As You Think Money Metagame

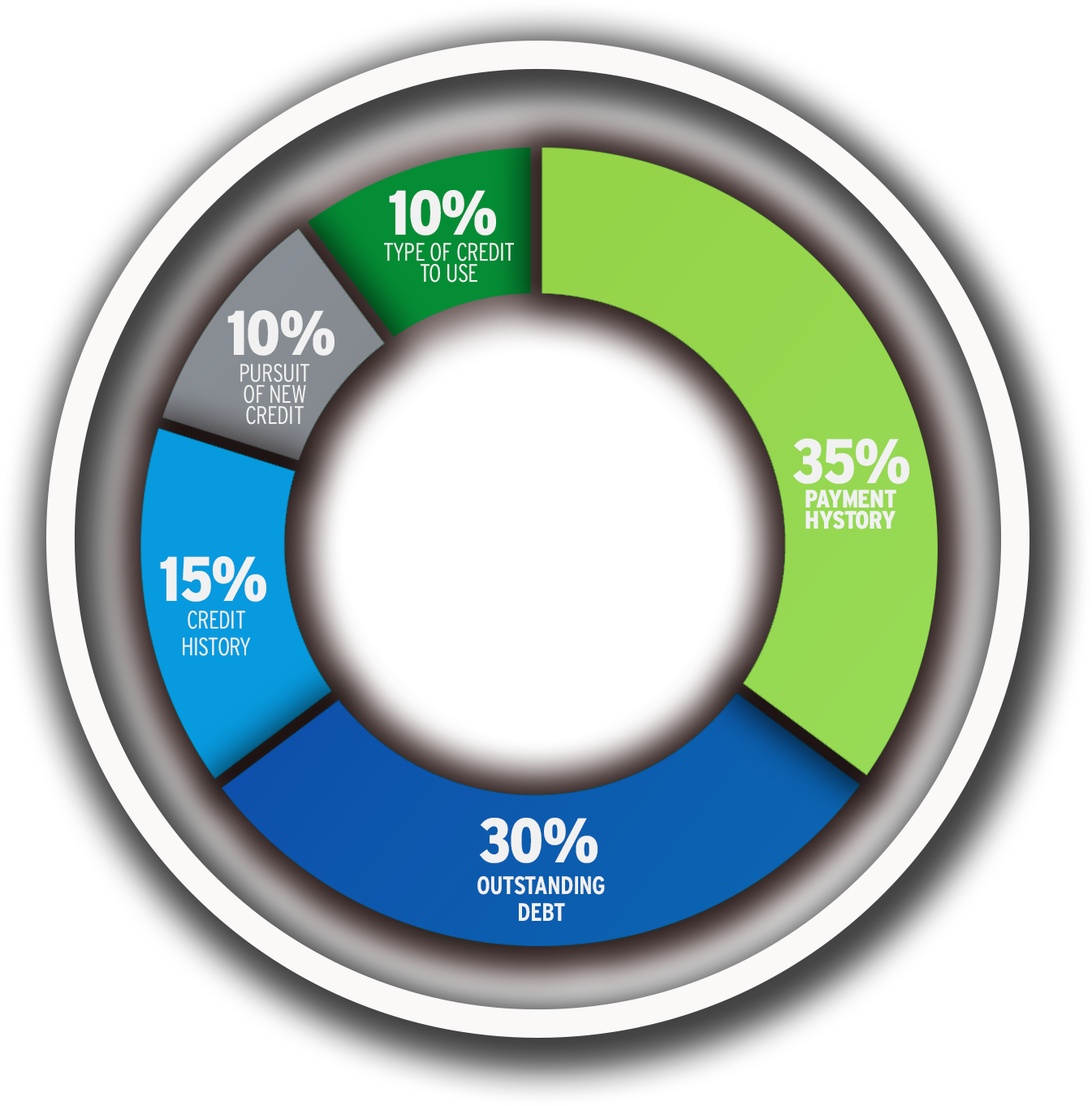

Once lenders know your FICO score they can determine how.

. In 1989 can range from 300 to 850. Web Most mortgage lenders use the FICO Credit Scores 2 4 or 5 when assessing applicants. Lets say you get a 30-year fixed-rate mortgage for 200000.

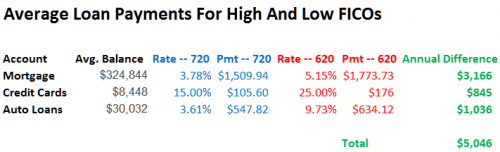

Web Mortgage Savings. Web A person with a 760-850 FICO score could secure a 30-year fixed mortgage with a 4147 interest rate. Web This score range is further divided into tiers which can help you understand how lenders and others may view your score.

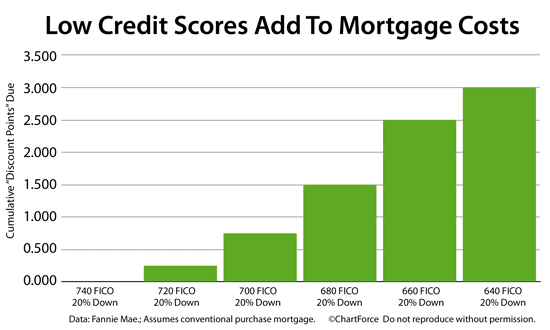

Web The lending industry carves up the credit score scale into 20-point increments and adjusts the rates it offers borrowers each time a credit score moves up. Web Enter a 200000 principal on a 30-year fixed-rate loan and your credit score ranges mortgage rates and overall costs might look something like this as of July. Web Heres an example.

Web The calculation is simply the percentage of your total gross income allocated for paying debt each month which should not exceed 30. Web According to FICO the current interest rate for a 30-year fixed mortgage is 2377 APR for a 760 borrower and 3966 for a borrower with a score between 620. While each lender is free to set its own rules many will follow.

Mortgage lenders who offer conventional mortgages are required to use a FICO Score. How to improve your credit. If you have a high FICO credit scorefor example 760you might get an.

Web Mortgage lenders use a FICO score to determine your creditworthiness. Scores which range from 300 to 850 help. Web Rates on 30-year mortgages climbed modestly reversing a two-day decline that had taken the average to a four-week low.

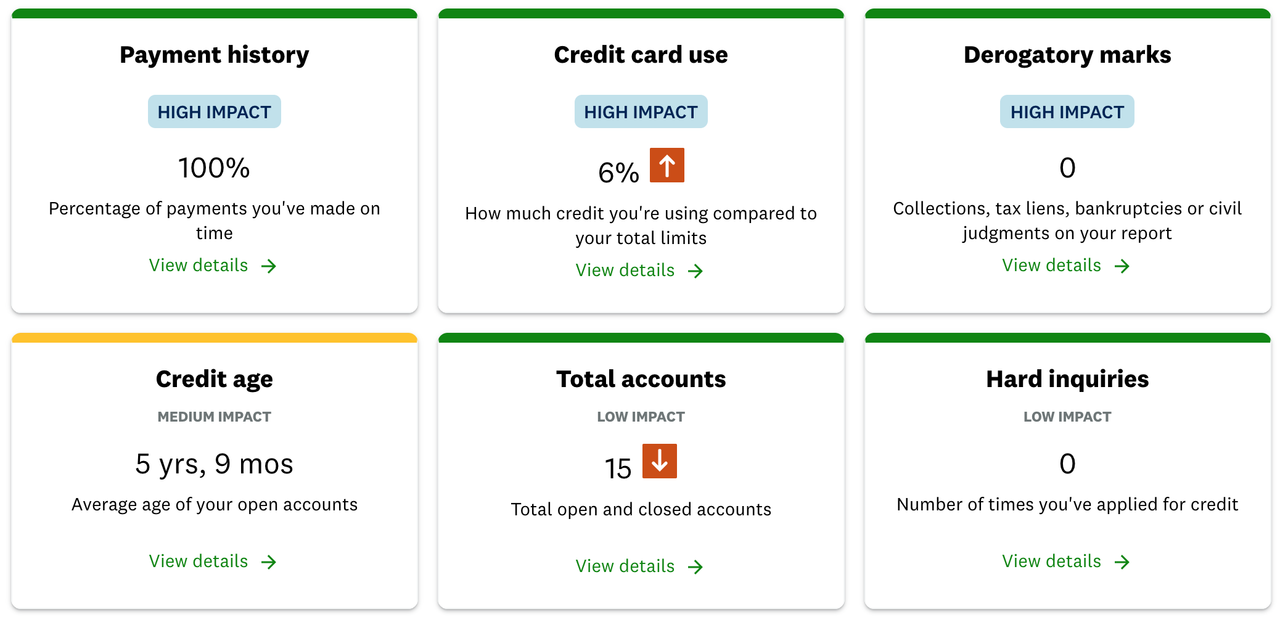

Web A FICO Score is a three-digit number that represents the amount of risk a prospective borrower poses to a lender. And it makes up 30 of your. Another strategy involves improving.

Web Minimum credit score to refinance. FICO Score APR Monthly Payment Total Interest Paid. Additionally one type of credit score to keep an eye.

Web Mortgage lenders typically use FICO Scores 5 2 and 4 when determining whether or not to approve a loan. Web Credit scores which were created by the Fair Isaac Corp. Web So lenders will look at the range in which your score falls and adjust your rate and fees accordingly.

620 to 720 depending on loan type and lender Conventional mortgages make up the majority of all home loans and are issued. LTV of 80 an applicant with a FICO. A 760 FICO borrower would pay just 030 he says.

This rate is more than 06 percentage points lower than the.

Equifax Credit Sample Equifax Credit Bureau Report Credit Report Template Equifax Credit Report Report Template Templates

What Credit Score Do You Need To Get A Mortgage Learn The Key Fico Thresholds

:max_bytes(150000):strip_icc()/dotdash_final_800_Plus_Credit_Score_How_to_Make_the_Most_of_It_Dec_2020-01-eab02cc511db4ce19ab3c1869e750d3b.jpg)

800 Plus Credit Score How To Make The Most Of It

How To Check Your Credit Score Rating Propertynest

Raise Your Fico 100 Points In 2023 And Save Big On Everything

Credit Score To Buy A House Best To Minimum Score Needed Zillow

Credit Score Under 740 Prepare To Overpay On Your Mortgage

What Credit Score Do You Need To Get A Mortgage Learn The Key Fico Thresholds

How To Remove 30 Day Late Payments From Reports 2023 Guide

How To Boost Your Credit Score To Improve Chances Of Getting A Va Home Loan Veteran Com

Buy A House Chip Jewell Mortgage Loan Officer

Mortgage Rates By Credit Score What Does Your Score Get You

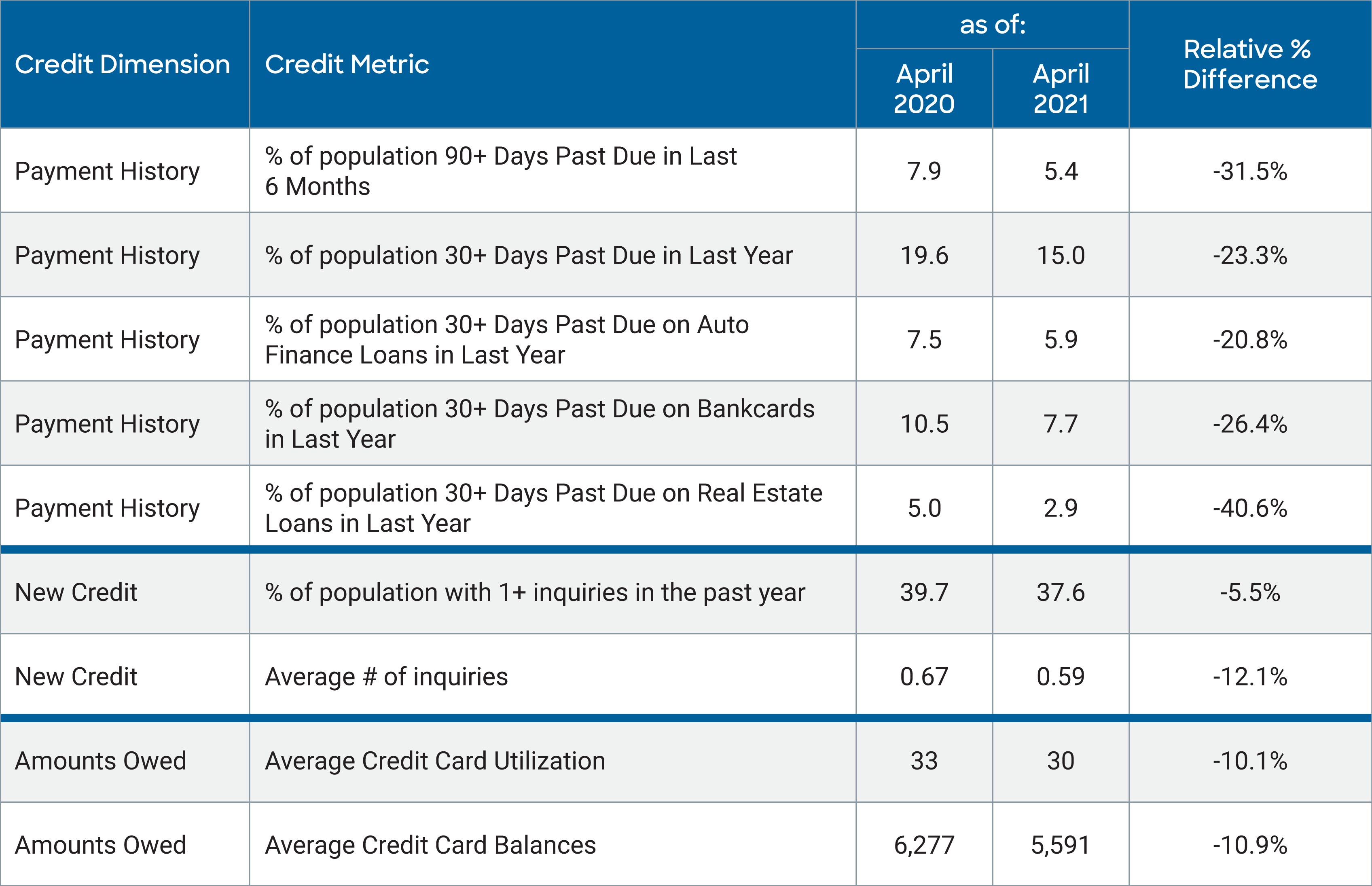

Average U S Fico Score At 716 Indicating Improvement In Consumer Credit Behaviors Despite Pandemic

Increasing Credit Score Fast Bogleheads Org

Improving Your Credit Score In The Military Veteran Com

How To Improve Your Credit Score Eric Patterson Branch Manager

Late On Your Mortgage Payment Here S How It Will Affect Your Credit Score Cbs News